Tax Services - Truths

Table of ContentsExamine This Report about Tax ServicesSome Known Factual Statements About Tax Services 3 Easy Facts About Tax Services DescribedThe Of Tax ServicesUnknown Facts About Tax ServicesSome Known Facts About Tax Services.

Thus, it just makes sense to make a list of reductions if the payer incurred qualifying costs in the year that will amount to over this amount. There are likewise a lot of readily available credit ratings that taxpayers might be qualified for. Rather of decreasing their taxed revenue (like reductions), credits straight lower the quantity of tax that's owed.Tax obligation brackets straight impact the payer's total tax liability. The dynamic tax system in the USA indicates that payers are tired extra as their income goes up. However, it is necessary to keep in mind that these higher rates do not relate to their whole income, just the section they've earned within the greater tax bracket.

Hence, it can be handy for payers to forecast their earnings for the coming year to figure out which brace they will certainly fall under, aiding their tax preparation and optimization initiatives (Tax Services). Improve your clients' wealth management with expense There are a number of points payers can do before completion of each year to reduce their taxable income and overall tax obligation concern

The Facts About Tax Services Uncovered

Again, this would just affect the part of the earnings that rests over the tax obligation brace limit. Nonetheless, doing so can help decrease their complete tax obligation responsibility for the year, so it might deserve it if there's some flexibility. As an example, let's say there's a local business proprietor that has just completed work for a client at the end of December.

Another handy technique is to sell shedding investments before the year ends to offset realized gains - Tax Services. This technique is also referred to as "loss harvesting," and may be handy to prevent or reduce the amount of short-term capital gains gained in the year, which are typically taxed at a greater rate than standard income

It's commonly suggested that those that have the readily available funding needs to max out their payments to the yearly limitation. This will certainly enable them to get the best tax benefit. In 2024, the maximum total payments to typical and Roth IRAs was $7,000 for those 49 or more youthful. People who are 50 or older can contribute up to $8,000.

This consists of maintaining the publications updated for local business owners and preserving precise records of all income and costs. Individuals need to keep necessary tax obligation records like any W-2s, 1099s, and other types referring to transactions or settlements made during the tax year. Payers can store physical copies of these documents in declaring closets or filing folders in the house or in their workplace.

Getting The Tax Services To Work

It's no key that tax-related topics can be frightening. They can be tricky to browse without the appropriate assistance, and might even result in pricey blunders. Skilled tax planning experts offer satisfaction that the taxpayer is making critical decisions and investment timing to sustain lasting monetary goals. browse around this web-site They can aid taxpayers execute comprehensive tax planning approaches that support both short-term and lasting economic objectives, while making certain conformity with tax obligation legislations and policies.

When clients value the worth of advising services, the following action is crafting a tailored strategy that lines up with their unique economic purposes. An extensive advising strategy may incorporate tax obligation planning, investment suggestions, retired life preparation, and estate management.

Not known Factual Statements About Tax Services

It is suggested to start exploring your tax obligation relief options at the beginning of the tax year as some might not be possible if you're declaring late in the year. Managing resources gains is a fundamental part of tax preparation as it can dramatically influence a person's or service's tax liability.

Proactive tax preparation is vital. We teach this all the time. Why? Since planning can conserve you time, tension, and cash, particularly when done with the help of a knowledgeable bookkeeping team like us. In this blog, we look at several of the top advantages of constantly being in communication with your accountant about your general tax obligation image.

Working with an accountant throughout the year allows you to recognize prospective reductions and credit reports early. Proper tax obligation planning aids you anticipate your tax liabilities and handle your cash circulation more successfully.

An accounting professional can supply calculated recommendations to reduce your tax obligations legally. This might entail changing your earnings timing, buying tax-advantaged accounts, or making calculated company decisions. Positive tax preparation aids ensure that you're in compliance with tax legislations and due dates. This reduces the threat of charges and interest that can emerge from late or inaccurate filings.

Fascination About Tax Services

Tax preparation is a lawful and moral method of maintaining tax obligations at the minimum level. Methods applied in tax obligation panning important site can be described illegal if they do not stick to legislation.

Aggressive tax obligation planning is essential. We preach this regularly. Why? Due to the fact that planning can conserve you time, stress, and cash, particularly when performed with the help of a skilled audit group like us. In this blog, we consider a few of the top benefits of constantly being in interaction with your accounting professional about your general tax obligation picture.

A Biased View of Tax Services

It is as straightforward as that. Functioning with an accounting professional throughout the year enables you to determine prospective reductions and debts early. This aggressive method ensures you don't lose out on any opportunities to reduce your taxed revenue. Appropriate tax planning helps you anticipate your tax obligation responsibilities and handle your capital a lot more properly.

An accounting professional can offer strategic recommendations to decrease your tax obligations lawfully. Proactive tax preparation helps go to website make sure that you're in compliance with tax obligation regulations and deadlines.

Tax planning is a lawful and ethical method of maintaining tax obligations at the minimal level. However, approaches used in tax obligation panning can be described unlawful if they do not abide by regulations. The techniques need to be based on legislation and judicial judgments on tax exceptions, argument, relief, and reductions. Tax preparation charges on the year of settlement are considered miscellaneous itemized reductions and can not be deducted from the taxpayer.

Ariana Richards Then & Now!

Ariana Richards Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Alisan Porter Then & Now!

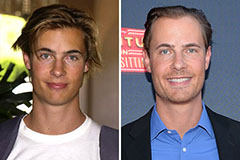

Alisan Porter Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!